Given that half of US adults lack adequate financial literacy themselves, it can feel overwhelming to instill financial wisdom in our own children. We might still be thinking, “I wish my parents had taught me more about finances growing up!”

As parents, you’re probably wondering:

- Am I teaching my kids enough about money?

- How much do kids really need to know?

- How early should I start teaching finances?

Money conversations come naturally, so you want to be prepared. When they lose a tooth, should the Tooth Fairy leave some coins, a couple bills — or something besides money? At the grocery store, do your kids know what you’re buying, how much it costs, and why it’s worth spending on?

Nurture is a kids’ app that develops Life Readiness skills such as creativity, curiosity, and critical thinking. All the more important in the age of AI, they're developed through fun, interactive, story-driven adventures. Nurture Academy — that’s where you are right now! — is for parents learning what it takes to raise smart, happy, and resilient kids in our increasingly digital world. We’re glad you’re here!

Read on, then discover how Nurture works or get the app.

How do your kids perceive the concept of work, and why parents have to trade time with their family to go off and earn money? You can find opportunities to explain to your kids all the things you work hard to pay for, like housing, groceries, entertainment, schooling, child care… the list goes on (as long as their attention span allows).

But what level of financial education is right for kids at the malleable early school ages between 4 and 7? It can be tricky to know what’s not enough or what’s too much when it comes to financial literacy for your kids.

The Right Lessons for Every Age

Do kids need to be exposed to finances? Yes, absolutely — in age-appropriate ways.

Nurture partner Barbara Coloroso, internationally recognized expert on inner discipline and ethical decision-making for kids, touches on many vital financial literacy lessons in the “Money Matters” chapter of her book, kids are worth it!1.

With age-appropriate guidance — learning by doing — parents can teach children to be responsible with money and independently make disciplined, thoughtful, and competent financial decisions.

Financial literacy for kids doesn’t mean memorizing economic terms or calculating compound interest. For this age group, financial literacy is about learning how to make healthy, thoughtful decisions about money.

And one of the best ways for kids to learn financial literacy is through play!

What is Financial Literacy for Kids?

Financial literacy for young kids is the foundation for how they’ll think about money later in life. Studies show that financial habits start forming before age 7.

At this stage, that means learning the basics:

- What money is used for

- How to earn and spend it

- Why saving money is important

- How to share or give generously

It’s less about definitions and math, more about thoughtful decisions and good habits. Kids can begin to learn about value, trade-offs, and why we even use money. They can also begin to grasp where it comes from and where it goes.

Take allowance, for instance. Coloroso emphasizes allowance not as a lesson in making money, but in managing it: “The job children have with their allowance is to work with it,” she says, not to earn it.

“I think it is unrealistic to teach children that the harder they work, the more money they will earn. It’s just not true,” Coloroso explains in her book. “What is important for kids to learn is that no matter how much money they have, earn, win, or inherit, they need to know how to spend it, how to save it, and how to share with others in need.”

That’s where parents come in. With support, structure, and curiosity, you can introduce financial literacy concepts in a way that fits their age and development.

Why Teaching Financial Literacy Early Matters

“The best time to start giving your children money is when they will no longer eat it,” Coloroso says.

As soon as they can recognize it, practice counting it, and begin to track it, financial literacy begins to form. Some of the earliest lessons might simply be around:

- How much money is it?

- What can it be used for?

- When and how should they spend or save it?

Early money lessons can help kids:

- Delay gratification (“I’ll wait and save instead of spending right now.”)

- Recognize the difference between wants and needs

- Think critically through trade-offs

- Avoid entitlement by linking effort and reward

- Build empathy and generosity through sharing

Chances are, you made your own mistakes with money as a kid or young adult — and wish you had been given more support in your own financial literacy earlier on. The goal isn’t to eliminate mistakes but to help kids develop the thinking to learn from them.

Coloroso emphasizes trust and learning as parents give money to their kids. They want to avoid implying that money is a status symbol, a sole form of security, or simply a type of reward or punishment. Parents also want to avoid implying that money is unpredictable or that children can’t turn to their parents for help in making decisions when they need support.

Financial literacy for kids is a balance of modeling, teaching, and doing. Kids will pick up on the money behaviors of their parents just as much (or more) than the financial lessons they’re taught.

Core Money Concepts for Kids Ages 4–7

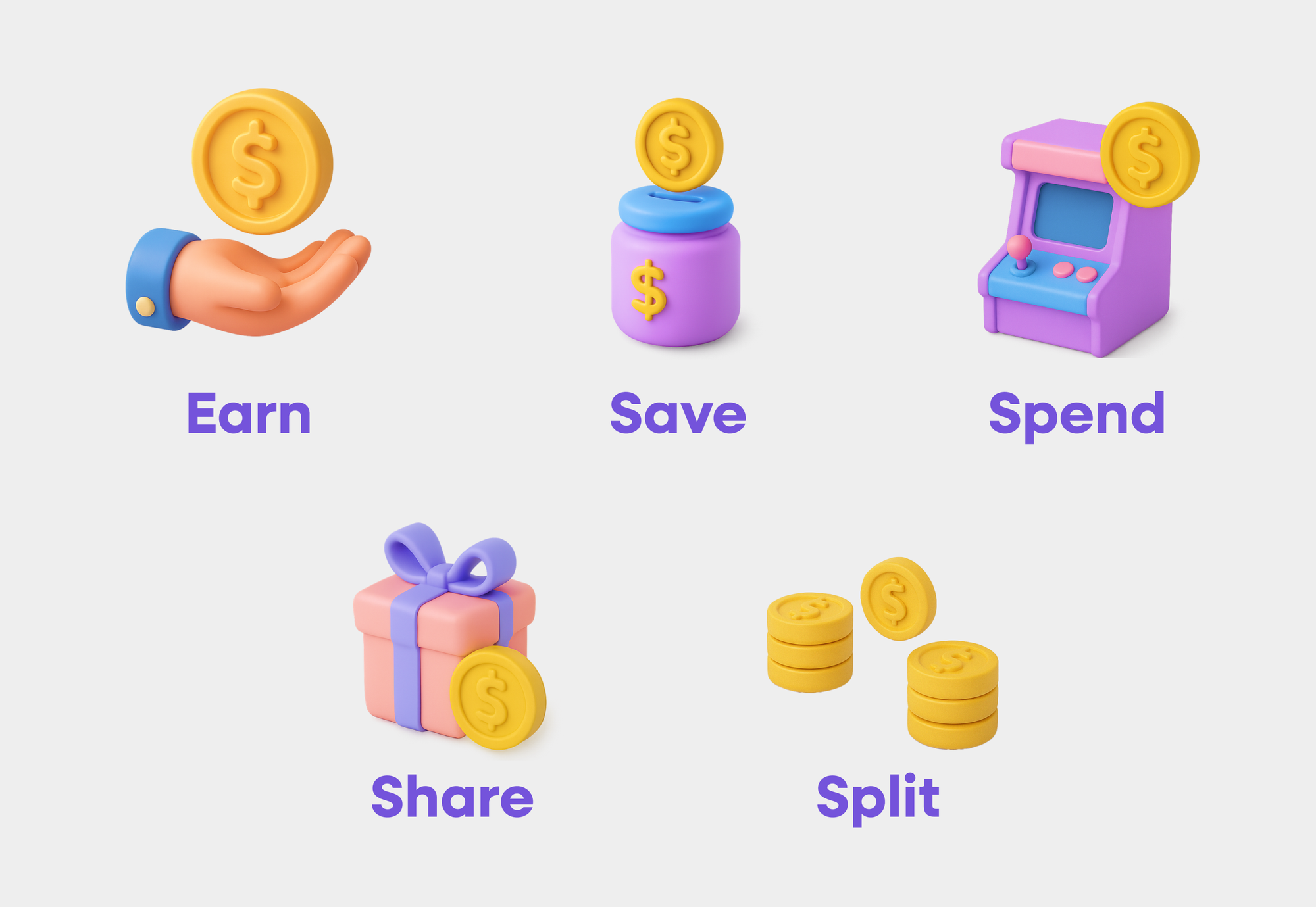

Kids learn these lessons best by living them in small, simple, age-appropriate ways. That’s what builds the foundation for long-term confidence and competence with money. Financial literacy at ages 4–7 should focus on experience: earning, saving, spending, sharing, and splitting.

“By constantly increasing the responsibilities and decisions our children have with their own money from the time they are toddlers, we can help make sure that by the time they leave home, they will be able to spend, save, and give in a caring, creative, and responsible way,” says Coloroso.

Age-Appropriate Money Lessons

The foundations of financial literacy start earlier than most people realize. As early as age 2 — as long as they can handle coins safely — you can give kids small denominations for their own piggy bank. They can begin to recognize coins and their values, while keeping track of their balance by noting how many of each they have.

Coloroso advises that, around age 3, it can be helpful to give your kids three banks: one each for spending, saving, and sharing. “As they get in the habit of spending, saving, and sharing, and learn more about why we do it, they will adjust the amount on their own accord,” she says.

As their understanding of money develops, you can apply more guidance on how they split their banks, but still empower them to make their own choices. Giving advice without strict orders instills trust and helps them develop their own financial thinking. Knowing they can count on you for help encourages independent decision-making and the space to learn from their mistakes.

By ages 5-7, you can likely layer in concepts of budgeting, value-for-money, and extra earnings. If your kid wants to buy something they can’t yet afford, it’s a prime opportunity to learn about savings plans, opportunities to earn extra cash — and whether the purchase is worth the expense.

Throughout every stage, conscious parental modeling helps enforce financial literacy for kids. Explaining how you earn, save, and give to charitable causes can instill lifelong values and confidence in what they’re learning.

As kids approach their teenage years, they can gradually take on more abstract financial concepts, like interest, investing, and longer-term goals. You can even begin exposing them to household budget decisions — just make sure you feel confident in your own financial plans before involving the kids.

For kids ages 4–7, especially, learning through concrete experience is far more effective than introducing abstract math or financial jargon. At this age, it’s not about financial formulas. It’s about developing a mindset:

- “If I spend it all now, I won’t have enough later”

- “If I save this, I can get something bigger or better”

- “If I share some of my money, I can help someone else feel happy, too”

Financial literacy for kids can be broken down into these key categories to make sense for early learners: Earning, saving, spending, sharing, and splitting.

Earning: The Value of Effort

Kids can begin to understand that money comes from effort outside of their existing responsibilities. Things like helping set the table or picking up their toys are the baseline and not where you want to introduce earning.

Instead, target chores that would fall outside the normal family expectations of your household. This way, they can begin to understand the value of earning money through additional effort without confusing the expectations of how they should generally be showing up as an engaged and helpful member of your family.

You’re helping them link effort to reward, and that helps avoid entitlement later.

Saving: Waiting is Worth It

“A child needs to have a bank from an early age,” Coloroso explains, “but let him choose it, whether it’s the classic piggy bank, the even more classic old sock, the jar the gerbil food comes in, or one he makes himself out of Legos.”

Encourage short-term savings goals. Help them pick something they want and create a savings plan — whether it’s coins in a jar or a simple allowance tracker. Celebrate their success to reinforce the idea that patience pays off.

Spending: Making Trade-Offs

Spending isn’t bad, of course, but it does come with decisions. You can teach kids to ask questions like:

- Do I really want this now?

- Will I regret not having money for something else later?

- Is this a good use of my money?

- How do I value experiences: things we get to do together?

- How do I value goods: things I get to keep?

These little trade-offs help kids build confidence and decision-making skills. While it may sometimes be hard to believe, young kids can have exceptional self-control given the guidance and opportunity.

“Even toddlers can learn how to avoid impulse purchases,” explains Coloroso. “You can allow a lot of freedom to young kids to buy what is meaningful to them, and they will begin to develop their own financial acuity in understanding and using money.”

Sharing: Empathy Through Giving

Even a small donation or thoughtful gesture can help kids understand generosity. Let them help choose a cause or recipient. Talk about how giving impacts others and why it matters. This builds empathy, values, and a deeper understanding of money’s role in the world.

Charitable giving should be a core element of your kid’s financial upbringing, not an afterthought.

Splitting: Money for Multiple Goals

From the very beginning of their financial learning journey, it’s important to introduce the idea of splitting their money: a little for saving, a little for spending, and a little for sharing. You can even label three jars or envelopes to make it visual and fun. Splitting money can help kids widen their perspective on finances and make more complex decisions.

How Kids Learn About Money (And How to Teach It)

When it comes to learning, young kids absorb more from what they see and do than what they’re told. That’s why one of the most powerful ways to teach kids about money is simply through everyday experiences.

Coloroso explains this approach to kids’ financial literacy through the lens of allowances. Parents might approach allowance in three general styles. A “brick wall” allowance gives kids money, but micromanages how they use it, depriving kids of money-related learning experiences. A “jellyfish” allowance does the opposite, giving a child money with no guidance, so they risk learning bad habits or nothing at all. The “backbone” allowance, however, advocates for enabling children with funds to save, give, and spend with freedom and flexibility, while also providing guidance and examples when needed.

Parents as Financial Role Models

Kids model the financial behaviors they observe. Whether it’s saving loose change in a jar or comparing prices at the grocery store, these moments lay the groundwork for how kids think about money. The key is to bring them into the process, even in small ways. It’s beneficial to teach children not just what we buy, but why we buy it.

Coloroso also encourages parents to explain to their kids what they’re paying for when they sit down to settle their bills. It’s the perfect opportunity to explain how the Internet, groceries, electricity, and water (needs) are balanced with saving for a vacation (want) and with giving to organizations we care about (giving).

Make Room for Mistakes

Let kids make little money mistakes while the stakes are low. If they spend all their allowance right away and realize they can’t afford something later, that’s a valuable (and memorable) lesson. Learning through experience fosters resilience and better long-term habits.

Coloroso gives an example of a kid who frivolously spends, then can’t afford to pay her portion of an upcoming educational (yet optional) trip. Instead of denying the opportunity or overlooking the financial misstep, a parent teaching financial literacy can cover the cost, but work out a repayment plan.

Encourage Values-Driven Spending

Talk about why you save, donate, and make choices that help others as well as yourself. These conversations, especially when grounded in your family’s values, help kids build a more ethical and empathetic approach to money.

Wants and needs are a critical element of this. Coloroso explains, “We have an obligation as parents to give our children what they need. What they want we can give them as a special gift, or they can save their money for it.”

The Power of Play

Money is, of course, a very serious thing — but that doesn’t mean it can’t be taught in fun, engaging, interactive ways that kids actually enjoy. At this age, play is one of the most effective learning tools available.

Using Games to Teach Kids About Money

Kids love to play — and when money concepts are introduced through fun, interactive experiences, those lessons tend to stick.

Games offer:

- A safe place to explore and make decisions

- Opportunities to practice trade-offs and budgeting

- Hands-on learning that feels like fun, not homework

While many money-minded games exist in stores and online, they are often targeted towards older children, and don't actually focus on building healthy, pro-social money habits. Imagine if everyone you knew always acted like they were playing Monopoly. Is that the relationship you want your children to have with money?

More traditional “playing pretend” (role-playing) activities often meet kids ages 4-7 at a more approachable, comfortable, and engaging level. Think of simple games like:

- Playing grocery store and letting kids shop and check out

- Acting as a cashier to other play “customers” in a pretend shop

- Using old gift cards, coupons, and play money to re-enact common money exchanges

The goal is to make financial learning feel natural and joyful.

Raising Financially Healthy, Aware, and Responsible Kids

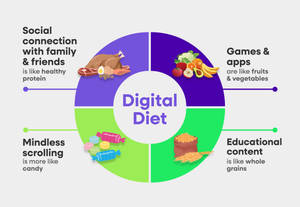

Financial literacy isn’t a one-time lesson. Just like other healthy habits around nutrition, screen time, and social behaviors, it’s a practice shaped by daily interactions, parental examples, and steady reinforcement. Remember to:

- Be consistent, incorporating financial thinking in daily life

- Adapt with age to introduce more complex ideas over time

- Focus on working with money, not for money

- Model healthy habits so kids can learn from what you do, not just what you say

Above all, aim to cultivate a positive mindset around money. Show kids that money isn’t always about having more, it’s about making smart, thoughtful choices.

“From as young as 2 or 3 years old, we should be talking with our kids about spending, saving, and sharing money — building foundations for lifelong financial literacy,” Coloroso says.

“When kids learn to make choices, explore their values, and understand the difference between needs and wants through financial situations, they’re exercising confident, responsible, and compassionate decision-making.”

As parents, our ultimate goal is to raise confident, responsible, and thoughtful kids who understand that money is a tool and not a stressor. Make financial literacy part of your family’s everyday learning. Try games, conversations, and everyday choices that bring money lessons to life.

They don’t need to master every financial concept right now. But they do need space to explore, practice, and grow into their money skills. Meet kids where they are — start small and make it fun!

1Barbara Coloroso, kids are worth it! raising resilient, responsible, compassionate kids (Penguin 2010).

Copy Link

Copy Link

Share

to X

Share

to X

Share

to Facebook

Share

to Facebook

Share

to LinkedIn

Share

to LinkedIn

Share

on Email

Share

on Email